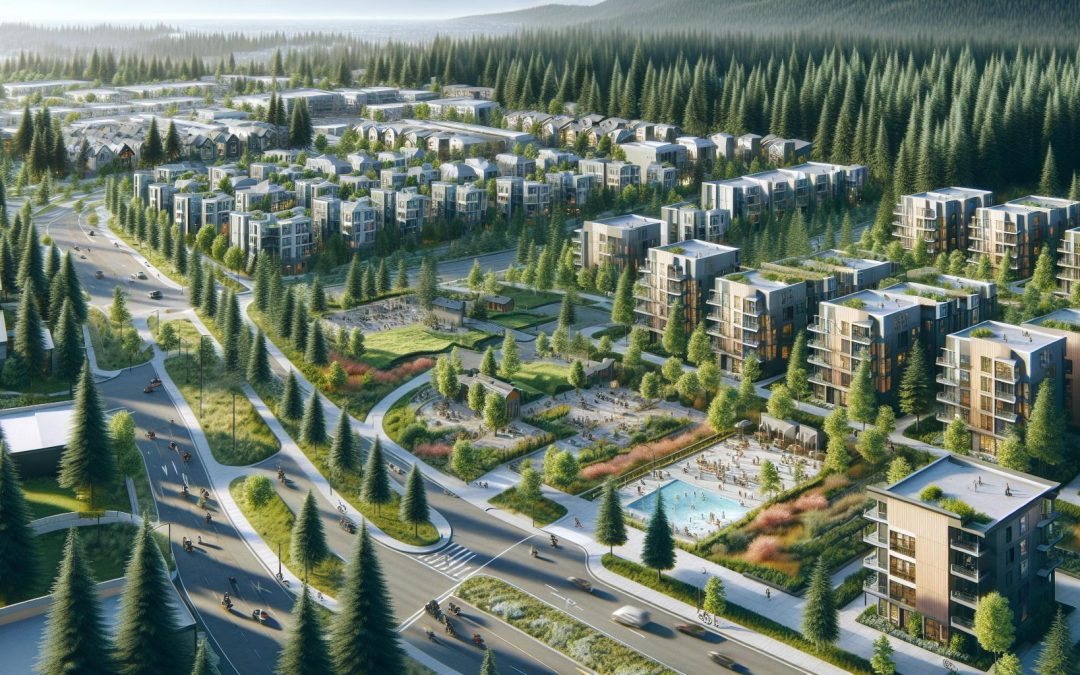

Sammamish, a gem tucked away in the Pacific Northwest, is more than just a picturesque city. It’s a place where dreams can take root and flourish, especially for those seeking to build wealth. With its thriving economy and high standard of living, it’s no wonder why many are drawn to this city.

But how does one navigate the path to prosperity in Sammamish? How can you tap into the city’s wealth-building opportunities? That’s exactly what we’ll explore in this article. From real estate investments to flourishing local businesses, we’ll delve into the secrets of wealth creation in this beautiful city. So sit back, relax, and let’s embark on this journey to financial success together.

Understanding the Wealth Landscape in Sammamish

Sammamish presents varied opportunities for wealth accumulation. Let’s delve into its economy and wealth demographics to understand the city’s financial panorama better.

Key Economic Indicators

Sammamish demonstrates strong economic vitality, informed primarily by key components such as the city’s top-notch jobs market. With a low unemployment rate of 3.5%, compared to the national average of 6.7%, it’s evident job opportunities abound here. Additionally, the average income of Sammamish residents is $183,038, nearly triple the US average of $61,937, highlighting a blooming economy.[^1^]

The cost of living, another crucial economic indicator, is approximately 79.3% higher than the national average, with housing being a leading factor.[^2^] That puts forth a compelling reason for prospective investors to consider real estate in their wealth-building strategy.

[^1^]: Bureau of Labor Statistics

[^2^] Numbeo

Wealth Distribution

Wealth in Sammamish is fairly evenly spread, a fact confirmed by its Gini Coefficient of 0.41, just slightly higher than the US average of 0.48.^[3^]. Development of high-income professions in sectors like technology, a surge in property values over the last decade, and the presence of affluent neighborhoods, are primary reasons contributing to this wealth dispersion.

Additionally, almost 74% of the families in the city have an income of over $150,000 and around 54% of households own real estate properties.[^4^]. Thus endorsing, both high-income employment and property investment, are clear paths to wealth building in Sammamish.

Building Wealth: The Sammamish Real Estate Market

Diving deeper into Sammamish’s wealth-building avenues, property investment emerges as a critical player. Let’s explore how understanding this market can prove fruitful.

Understanding Property Investment

In Sammamish, property investment isn’t just about purchasing a house; it’s a strategy for securing financial growth. For example, home prices in Sammamish increased by an impressive 4.5% in the last year, indicating the strong potential for profits. Buying or investing in housing can also provide consistent rental income. It’s interesting to note, 46% of homes have at least two bedrooms, perfect for renting to small families. Moreover, the low vacancy rate of just 3.8% makes rental properties in Sammamish a safe bet.

Rental yield – a key figure in evaluating rental prospects – is obtained by dividing the yearly incoming rent by the property’s market value. Owners can enjoy strong net incomes with Sammamish’s annual rental yields on par with the national average.

Real Estate Trends in Sammamish

Keeping track of local real estate trends, crucial for success in the property market, isn’t as daunting as it might seem. Over the past decade, median home value in Sammamish has skyrocketed from $413,100 in 2009, to a stunning $830,800 in 2019.

Data suggests this upward momentum isn’t slowing. In fact, housing market predictions for Sammamish suggest an additional 7.5% growth in home value over the next year.

Despite the high cost of property, Sammamish’s residents appear to consider it a worthwhile investment, with over half of them owning their homes.

By buying property in Sammamish, investors not only secure a tangible asset, they also enter a steady market likely to register consistent growth. With the right investment choices, one can grow wealth significantly in this Pacific Northwest gem of a city.

The Role of Business Investments

As we dive deeper into wealth-building in Sammamish, let’s explore another key avenue: business investments. Here, we’ll spotlight profitable businesses and successful local entrepreneurs.

Profitable Businesses in Sammamish

Sammamish benefits from a diverse range of productive commercial endeavors. Among the numerous sectors, Tech-based enterprises stand out as particularly profitable, capitalizing on the city’s close proximity to Seattle’s booming tech industry. Leading companies like Microsoft, Amazon, and Google have offices nearby. This, in turn, creates a fertile ground for tech-based startups and consultant businesses in Sammamish.

Alongside this, niche industries like event catering, dog-walking, and landscape services have seen growth, demonstrating Sammamish’s capacity for thriving small businesses. Catering businesses, for instance, are fueled by the city’s bustling event scene, while dog-walking services are popular among the city’s pet-friendly residents.

Success Stories of Local Entrepreneurs

One sees the power of business investments through the success stories of local entrepreneurs. Take the example of Andrew Ballard, founder of Marketing Solutions, a company that develops research-based growth strategies. Starting as a small business in Sammamish, Marketing Solutions has grown into a sought-after consultant firm because of Ballard’s innovative strategies and the growing demand for marketing consultation.

In another striking example, we have Emily and Elizabeth Kim, sisters who started Moonie Icy Tunes, an ice cream truck company. What began as a nostalgic nod to their childhood ice cream truck experiences has transformed into a successful venture that now includes several trucks and caters to numerous events in and around Sammamish.

Through these windows of business investment, there lies potential for wealth building in Sammamish, providing both residents and investors diverse avenues to grow financially.

Sammamish Stock Market and Investments

Sammamish’s potent economy presents itself as a sound stage for stock market investments. The city’s financial health and residents’ impressive purchasing power open avenues for meaningful and beneficial returns.

Evaluating the Local Stock Market

A crucial element in the wealth building journey is understanding the nuances of Sammamish’s local stock market. It’s an area that exhibits considerable growth, given the city’s proximity to the thriving hub of Seattle’s tech industry. Major stocks have ties to technological giants such as Microsoft, Amazon, and Google, well-established companies with strong performance histories. The local market also thrives on shares associated with smaller businesses excelling in diverse sectors. Stocks representative of local success stories like Andrew Ballard’s Marketing Solutions and the Kim sisters’ Moonie Icy Tunes form part of the city’s diverse investment basket. Keep in mind, an informed investor considers factors like a company’s fiscal health, its operational sector’s future prospects, and economic forecasts. Resources like portfolio management tools and financial consultancy services provide necessary assistance, helping deduce and manage risk-reward ratios to yield effective returns.

Smart Investing Strategies

Smart investing strategies pave the way for successful wealth accumulation in Sammamish. The city’s robust financial landscape provides a foundation for a range of strategies, be it value investing, growth investing, or income investing.

Value investors look for stocks perceived as undervalued relative to their intrinsic worth. Companies with stable financials but temporarily undervalued stocks—mostly due to market fluctuations—are prime targets. Growth investing, by contrast, identifies businesses showing above-average growth, regardless of the current stock price—tech stocks exemplify such opportunities.

Income investing focuses on generating steady income, primarily through dividend-paying stocks. It’s an effective approach, particularly for retirees seeking a regular income stream. Keep in mind, balancing these strategies according to your financial goals, risk tolerance, and investment timeline optimizes investment returns, facilitating robust wealth building in Sammamish.

Financial Planning for Wealth Building in Sammamish

Reaping the benefits of Sammamish’s robust economy entails astute planning of financial activities. Let’s dive into the significance of expert advice and intellective tax planning for steady wealth accumulation.

Importance of a Financial Advisor

A financial advisor provides pivotal support in charting your wealth building journey in Sammamish. They offer personalized strategies, taking into account specific financial goals, present financial condition, and risk profile. For instance, their advice might be instrumental when deciding between investment options, like buying property in Sammamish’s booming real estate market, putting capital into thriving local businesses, or investing in prominent stocks. Furthermore, they guide on when to enter and exit investments, reducing the risk caused by market volatility.

In addition, advisors disentangle complicated financial situations and provide simplified explanations. An example is estate planning; understanding associated laws can be challenging without expert guidance. They use their comprehensive knowledge to develop practices that foster financial growth while protecting assets from potential pitfalls.

Tax Planning and Wealth Management

In the wealth-building equation, tax planning plays a critical factor since taxes significantly impact net investment returns. Implementing smart tax strategies enhances financial growth by minimizing tax liabilities.

For instance, consider real estate investments in Sammamish. Shrewdly leveraging tax benefits can augment returns. Investors might benefit from mortgage interest deductions, property tax deductions, and can also defer tax payments through techniques like a 1031 exchange.

Involving in local businesses, one can take advantage of various tax incentives provided by the city to support small enterprises. This might include deductions on business expenses such as office supplies, or vehicle expenses if it relates to your business.

On the shares front, capital gains tax plays a vital role. It’s essential to know when to hold or sell stocks to optimize tax liabilities. For example, holding shares for more than a year entitles an investor to long-term capital gains tax, typically lower than short-term.

Conclusively, a well-designed tax plan helps in asset preservation and accelerates wealth accumulation, putting you on the fast track to building wealth in Sammamish.

Community and Networking Opportunities

In Sammamish, engaging with professional communities and participating in wealth-building networking events play crucial roles in growing personal financial wealth.

Engaging with Professional Communities

Becoming involved with professional communities in Sammamish is one significant way of strengthening financial prospects. I’ve noticed that local professional groups and organizations are vibrant platforms that inspire knowledge sharing and mutual growth. For instance, the Sammamish Chamber of Commerce provides numerous opportunities to connect with established local businesses, encouraging socio-economic engagement across the city.

Tech professionals can especially benefit from this region’s proximity to Seattle’s tech giants, such as Google and Microsoft. They offer various meetup groups, like the Google Developers Group or Microsoft’s .NET Developers Association, where one can learn about the latest trends and possibilities directly from industry veterans. It’s imperative to understand, though, that these professional communities aren’t only about what you obtain; they’re as much about what you contribute.

Wealth-building Networking Events in Sammamish

Attending networking events specific to wealth-building in Sammamish is another useful strategy. Many of these events aim at facilitating dialogues about financial growth, including discussions on property investment, stock market strategies, and setting up small businesses. For example, Sammamish’s “Investor’s Business Daily Meetup Group” provides a robust platform for aspiring investors to talk about their financial plans and glean insights from seasoned investors. It’s also worth noting that such events often host various successful local entrepreneurs and financial advisors, providing an excellent opportunity to learn from their experiences first-hand.

But remember, networking doesn’t stop when the event ends. Savvy networkers know that it’s vital to follow up, nurturing connections, resolving queries and deliberations, and sometimes, even establishing mutual mentorship. After all, building wealth in Sammamish is as much about gaining new knowledge and insights as it is about building substantial relationships that contribute to financial growth and success.

Conclusion

I’ve got to say, building wealth in Sammamish seems like an exciting adventure. The city’s strong economy and high average income make it a hotbed for financial growth. Whether it’s through real estate investments, launching a thriving business, or smart stock market strategies, there are plenty of avenues to explore. And let’s not forget the power of networking. Engaging with the community, attending events, and making valuable connections can open doors to opportunities you might not have considered. So, if you’re thinking of making a financial move in Sammamish, you’re onto something big. As we’ve seen, it’s not just about having the resources, but also about making the right choices and leveraging the opportunities that this vibrant city offers. It’s clear that Sammamish is a city where dreams of wealth accumulation can become a reality.

0 Comments