by EastSide Explorer | Aug 18, 2024 | Sammammish

Sammamish, a city with an undeniable charm and natural beauty, has a reputation for being one of the pricier places to live in Washington state. But don’t let the high cost of living deter you! I’ve got some tips and tricks to help you navigate and make the most of life in this beautiful city.

Living here might seem daunting due to the costs, but it’s all about knowing where to look and how to budget. In this article, I’ll share my insights and experiences to help you thrive in Sammamish without breaking the bank. So, if you’re planning a move or already living in Sammamish, stick around! There’s plenty to learn and discover about making this city your affordable home.

Navigating the High Cost of Living in Sammamish

Navigating the high cost of living in Sammamish isn’t a cake walk, but it’s definitely possible. In this section, the focus is on understanding the cost of living index as well as the factors that affect such high expenses.

Understanding the Cost of Living Index

The Cost of Living Index is a handy tool that compares the cost of living in different areas. It takes various expenses into consideration, such as housing, groceries, utilities, transportation, and healthcare, compared to the national average. Sammamish’s Cost of Living Index is 307.3, according to Best Places. That’s significantly higher than both the Washington state average of 118.7 and the national average of 100. Understanding this index holds key to realizing why life in Sammamish might require substantial financial planning. Grabbing its details, readers can plan their expenditure and save wisely.

Factors Influencing the High Cost of Living

Several factors influence the high cost of living in Sammamish. First off, the housing market in Sammamish is highly competitive, with median home prices lying around $831,200, well above the national average. Secondly, the city is seen as a desirable place to live due to its excellent schools, safe neighborhoods, and abundant nature. This popularity pushes up housing costs as demand outpaces supply. Lastly, high income levels in Sammamish also play a role; the median income here is nearly double the national average, explaining why goods and services also fetch a premium. Understanding these factors can equip individuals with valuable insights to navigate the city’s high living costs.

Breaking Down Sammamish’s Cost of Living

To thrive amidst the steep cost of living in Sammamish, let’s delve into the main factors that bump up this city’s cost of living index to 307.3.

Housing: The Biggest Expense

Taking a lion’s share of the city’s cost of living, housing in Sammamish offers a unique predicament. The median home price hovers around $831,200—a reflection of the city’s sky-high real estate expenses. With Sammamish listed as one of Washington’s most desirable locations, its housing market sees a regular influx in demand. It’s not a shocker—considering the area’s charm and natural beauty—that homes prices are higher than most.

Transport and Commuting Costs

In Sammamish, commuting is another pocket-draining expense. Despite its relatively small size, locals face a sizable commute due to the city’s geographical layout. Many residents own cars, given that public transportation options are significantly less. Gas prices, parking, and the upkeep of vehicles make commuting a noteworthy part of Sammamish’s cost of living.

Education and Lifestyle Expenses

Boasting some of the finest schools in Washington state, Sammamish attracts many families eager for quality education. However, superior academic institutions often fetch higher prices, adding to the cost of living here. Lifestyle expenses too aren’t negligible. From grocery bills to health care expenses, keeping up with the city’s lifestyle necessitates higher spending. Still, with precise financial planning and some savvy saving tips, Sammamish’s high cost of living can be navigated proficiently.

Coping with the Sammamish Lifestyle

Living in Sammamish, steep expenses become part of everyday life. But, finding ways to stretch your dollars further isn’t as hard as it may seem. So, let’s dive deeper.

Local Low-Cost but High-Quality Amenities

First, utilize local amenities. In Sammamish, you’ll find a ton of inexpensive resources that offer great quality. For example, the city brims with free parks and trails. Enjoy a leisurely walk in Beaver Lake Park, or breathe in the refreshing air at Pine Lake Park. Not to mention, Sammamish Commons, a goldmine of community events and activities.

Next, libraries. King County Library System operates two branches in Sammamish–both packed with free resources. Countless books and digital materials provide endless opportunities for free entertainment and education.

Finally, don’t overlook community organized events. Farmers Markets, Outdoor concerts, and Summer Nights in the Park. Each provides low-cost family fun, building a sense of community in the process.

Making the Most of Public Services

Moreover, take full advantage of the public services on offer. Sammamish isn’t just pricy homes and beautiful gardens. It’s a town invested in its residents, providing robust public services.

Take public transportation, for instance. Avoid the headaches of commuting by using the King County Metro Transit. This regular, reliable service cuts down transportation costs.

Next up, public schools. Sammamish schools are among the best in the nation. Rather than splurging on high-cost private education, consider the top-rated public school systems.

Finally, remember health and recreation services. The Community and Aquatic Center offers affordable memberships and classes. Embrace a healthy lifestyle without burning a hole in your pocket.

Living in Sammamish may cost a pretty penny, but with the right approach, you’ll fall in love with this Washington gem without breaking the bank. Trust me, the lifestyle adjustments are well worth it.

Practical Ways of Saving in Sammamish

Living in Sammamish doesn’t have to break the bank. There’s an abundance of strategies available to make the most out of the high-quality lifestyle without exhausting your funds. Let’s delve into handy ways of economizing your expenses and finding budget-friendly activities in the city.

Budget-Friendly Activities and Destinations

One way of alleviating the high cost of living is by taking advantage of local, cost-efficient activities. Sammamish boasts diverse parks such as Pine Lake Park and Beaver Lake Park. These destinations, offering numerous free activities like hiking, picnicking, and bird watching, can serve as an economical weekend option. Additionally, the Sammamish Library, as a part of King County Library System, provides free access to books, workshops, and events for residents of all ages.

Local events such as farmers’ markets and festivals also offer inexpensive fun. The summer concert series at Pine Lake Park, for instance, provides free entertainment, and food vendors often offer meals at affordable prices. By prioritizing such activities, I ensure an enriching yet cost-effective lifestyle in Sammamish.

Economizing on Everyday Expenses

For daily expenses, simple modifications to habits can lead to substantial savings. For groceries, I shop at budget-friendly stores such as Trader Joe’s, and utilize coupons and discount offers to stock up on essentials.

When it comes to commuting, public transportation and carpooling prove to be economical choices. Furthermore, embracing sustainable practices like energy conservation and water usage reduction can significantly reduce utility bills in the long run.

Another critical saving strategy involves opting for public health facilities and schools, given their high standards and lower cost in comparison to private alternatives.

In essence, strategic spending and capitalizing on local resources can help curb living expenses in Sammamish while enhancing life quality.

Advantageous Aspects Despite High Living Cost

In spite of Sammamish’s steep living expenses, there exist noteworthy advantages. Delving into these benefits, we’ll uncover aspects revolving around civil infrastructure and services, as well as environmental and lifestyle perks.

Civil Infrastructure and Services

One cannot ignore the impeccable public services in Sammamish as part of the high living cost equation. From a robust library system to top-notch public schools, it’s a city that offers value for its price tag. The City of Sammamish’s public services make daily life convenient and reliable. Take, for instance, the frequency of waste collection—individuals never find themselves with overflowing trash, given the city’s practical waste management system. Road maintenance is another area where Sammamish shines: potholes and street damages are dealt with promptly, keeping routes safe. Public transportation options also abound, making commuting a breeze.

Environmental and Lifestyle Benefits

The high living cost in Sammamish also includes exclusive environmental and lifestyle benefits. It’s not merely a city but a sanctuary for nature enthusiasts. Sammamish is home to various parks and vast green spaces, such as The Beaver Lake Park or Pine Lake Park, offering ample opportunities for hiking, picnicking, and breathing in fresh air.

It’s difficult to put a price tag on the tranquility you experience amidst the city’s green spaces. The local community also encourages a healthy lifestyle, with diverse events, such as farmer’s markets and cultural activities, fostering a vibrant social scene. This sense of community camaraderie, coupled with the access to Mother Nature’s bounty right at your backyard, shapes a rich lifestyle that money alone may not procure elsewhere.

When navigating the high cost of living in Sammamish, it’s key to recognize the unique benefits embedded in that cost, illuminating the city’s true quality of life.

Conclusion

Living in Sammamish sure isn’t cheap. But with its top-notch schools, safety, and high income levels, it’s no wonder why. The cost may be steep, but there’s a silver lining. It’s about making the most of the city’s low-cost amenities and public services. I’ve found that things like visiting our beautiful parks and libraries, attending community events, and opting for cost-effective choices like farmers’ markets and public transport can really help stretch the budget. Plus, let’s not forget the undeniable perks of living here. From efficient waste management and well-maintained roads to the environmental and lifestyle benefits, I truly believe the high cost of living is worth it. After all, there’s more to life in Sammamish than just the price tag.

by EastSide Explorer | Aug 18, 2024 | Sammammish

Nestled between the lush forests of the Pacific Northwest, Sammamish, Washington is a treasure trove of local resources. From its rich soil to a community bursting with talent and creativity, there’s so much to tap into. But how can we truly leverage these resources to benefit our community and its future?

In this article, I’ll be exploring the myriad of local resources in Sammamish, and how we can harness them for sustainable growth. We’ll look at success stories, innovative ideas, and practical tips to inspire and guide us. So, if you’re a Sammamish local or simply interested in sustainable community development, stick around for an enlightening journey.

Understanding Sammamish’s Local Resources

Across Sammamish, local resources, both natural and cultural, present unique opportunities for development and growth. These untapped treasures suggest a wealth of potential for local sustainability projects and community initiatives. Here’s an exploration of Sammamish’s most vital resources.

Natural Resources

Sammamish, teeming with diverse natural resources, enjoys a landscape that combines tranquil forests, fertile ground, and vast waters. The lush greenery yields a rich array of flora and fauna, indicative of the region’s bountiful biodiversity.

For instance, the forests, home to native tree species like Western Hemlock and Pacific Red Cedar, promise ample raw materials for industries such as furniture production and eco-tourism. Moreover, the fertile farms produce nutritious fruits and vegetables, pointing to opportunities for a booming local food market. Lastly, the fresh waters of Sammamish’s lakes and rivers offer a potential foundation for a sustainable fishing industry.

Importantly, sustainable use of these natural resources can foster a healthier ecosystem, supporting both local wildlife and the community’s wellbeing.

Cultural Heritage and Assets

In line with its natural wealth, Sammamish also boasts a rich tapestry of cultural heritage and assets, deeply woven into the community’s fabric. Encompassing historical landmarks, traditional arts, and a vibrant array of community activities, these cultural resources offer extensive possibilities for sustainable urban development.

Among the key cultural assets are the city’s historical buildings, such as the Reard House and the Sammamish Heritage Society’s Log Cabin. Serving as conduits of the local history, these landmarks provide a firm sense of identity and offer potential for heritage tourism.

In addition, the highly engaged community regularly organizes local festivals, music concerts, and art fairs. These celebrations, often involving local artists and musicians, underline the potential for boosting the local creative economy.

Furthermore, Sammamish’s diverse community, a melting pot of numerous cultures, supplements the cultural richness, fanning the prospects for community-led initiatives and collaborations.

Overall, the abundant cultural heritage and assets in Sammamish offer the city exciting avenues for growth and development, building over time, a sustainable and lively community.

Leveraging Local Resources in Sammamish: Why It’s Important

The significance of harnessing local resources in Sammamish society cannot be overstated. Let’s dive into the economic and environmental implications.

Economic Benefits

Tapping into local resources in Sammamish offers numerous economic advantages. For starters, it fosters businesses in sectors like tourism, creative arts, and market farming. Patrons of Sammamish’s historical landmarks, for example, inject cash into the local economy, supporting jobs in heritage tourism. Sustainable fishing practices, contingent upon the availability of fresh waters, cater to local food markets and restaurants, creating a demand for goods and services, driving the employment rate up. The city’s forests and fertile farmlands, by allowing the harvest of raw materials for furniture production and market farming, facilitate entrepreneurship and business growth. As a result, income levels may increase, benefiting the overall economy of Sammamish.

Environmental Impact

Leveraging local resources can also have profound environmental implications for Sammamish. The careful management of these resources – such as the sustainable fishing in the city’s fresh waters, curbs overfishing. In turn, this protects aquatic biodiversity, ensuring a balance of species’ populations. Sustainable farming and forestry practices prevent resource degradation, maintaining soil health and promoting biodiversity. Additionally, local production reduces transportation needs, leading to lower carbon emissions. This may contribute substantially to the fight against climate change, blessing Sammamish with cleaner air and lesser environmental footprint. Therefore, it’s evident that the prudent use of local resources has the potential to boost both the economy and the environment in Sammamish.

Case Examples of Successful Resource Utilization in Sammamish

Let’s now navigate toward concrete instances where Sammamish’s local resources were leveraged successfully. I’ll focus on community gardens for local food production and cultural festivals.

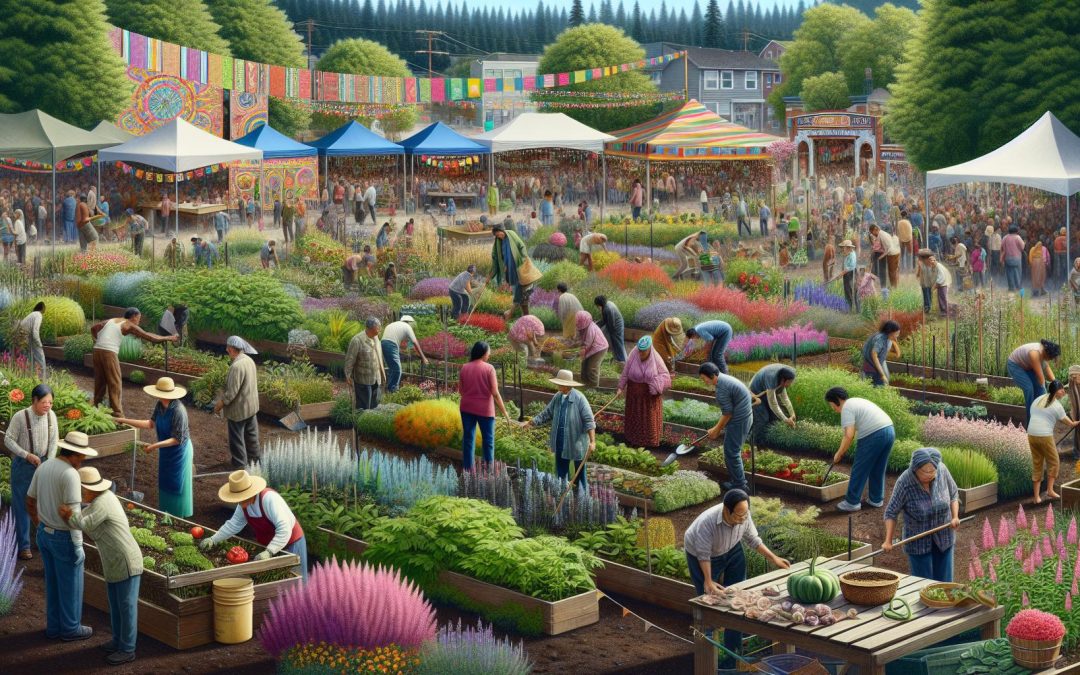

Community Gardens and Local Food

Community gardens are an excellent testament to resource usage in Sammamish. About 10 of these green spaces, nurtured by the locals, supply a significant portion of the city’s fresh produce. An example here is the Lower Bear Creek Community Garden. Spanning 14 acres, it houses over 50 gardening plots. Its harvests vary from strawberries to eggplants, supplying fresh, organic food to local markets. Besides food produce, such gardens serve as educational tools, where children learn about sustainable agriculture. Additionally, community gardens help in biodiversity conservation, and invariably establish a sense of community among the gardeners.

Heritage and Cultural Festivals

Sammamish’s cultural festivals are a perfect example of heritage resources being utilized. These events celebrate the city’s diverse cultural makeup, drawing in tourists from far and wide. Take, for instance, the Sammamish Days and Nights Jazz Music Festival. A yearly event known for its quality performances and local food, the festival attracts attendees by the thousands, enhancing the local economy significantly. It’s not just about leisure—these festivals educate visitors on the rich cultural heritage of Sammamish. Providing both economic and educational benefits, these festivals symbolize the successful utilization of cultural resources in the city.

Challenges in Harnessing Local Resources in Sammamish

Despite the opportunities, actualizing the potential of local resources in Sammamish isn’t without difficulties. Specific issues abound in legal and regulatory matters, as well as funding and economic considerations.

Legal and Regulatory Barriers

In the process of employing Sammamish’s resources, businesses encounter several legal and regulatory hurdles that restrict their operations. For instance, stringent environmental laws intended to preserve the city’s natural beauty, unfortunately, impose limitations on commercial activities. An example of these constraints includes specific zoning statutes that restrict farming or new constructions in specified areas of Sammamish.

Further, businesses also grapple with lengthy and complicated licensing processes. For example, potential restaurateurs aspiring to tap into the burgeoning local food market may find themselves constrained by the rigorous health and safety codes they must comply with. Additionally, heritage tourism businesses aiming to capitalize on the city’s rich cultural history may get mired in the regulations safeguarding these traditions, making it difficult to initiate viable economic operations.

Funding and Economic Challenges

Keeping up with the financial pressures in Sammamish presents a significant hurdle for entities attempting to leverage local resources. For one, high operational costs, particularly in industries like farming and creative arts, becomes an obstacle for businesses. Also, real estate pricing in Sammamish often discourages startups and small-scale industries, impeding the development of a diverse local economy.

Access to funding also poses a significant challenge. Traditional lenders often perceive businesses in sectors such as the creative arts and farming as high-risk, which makes obtaining loans difficult for many businesses. Crowdfunding and other alternative financial sources haven’t seen much success in Sammamish either, making it hard for businesses, particularly startups, to kick-start their operations and scale adequately. An example includes local artisanal craftsmen, who often struggle to find the necessary capital to expand their businesses.

Strategies for More Effective Leveraging of Local Resources

Effective utilization of local resources in Sammamish can be propelled forward by government initiatives and collaborative public participation. Let’s delve into the key strategies that can aid in overcoming the aforementioned challenges.

Government Initiatives

Given the constraints local businesses face, it becomes crucial for the governmental bodies to provide a helping hand. A plausible action plan could entail streamlining licensing processes and easing certain zoning regulations to foster growth. Particularly in sectors such as farming and heritage tourism, over-complication of licenses serves as a major hindrance.

Leaders might want to develop a simplified, yet comprehensive, framework that ascertains environmental safety and allows businesses to thrive. Additionally, amending strict zoning laws could result in creating more space for commercial activities, promoting growth in the city’s organization and structure.

Establishing financial support systems could be another lifesaver for businesses. Providing low-interest loans or launching industry-specialised grants may propel locally based businesses that could otherwise be outpriced or financially overburdened.

Public Participation and Collaboration

In addition to government initiatives, active public participation plays a crucial role in harvesting local resources. For instance, a successful example from Sammamish indicates that community gardens significantly boosted local food production. Encouraging community involvement in such initiatives can result in a greener, healthier, and more sustainable city.

Moreover, collaboration strengthens the sense of community. Businesses, NGOs, and residents can work together in organizing cultural events showcasing Sammamish’s rich heritage. Events such as the Sammamish Days and Nights Jazz Music Festival not only enhance the local economy but also serve educationally, showcasing the city’s rich cultural heritage to visitors.

In short, harnessing local resources in Sammamish relies heavily on strategic government initiatives and robust public participation. By enhancing collaboration and easing the process for businesses, the city’s potential can be reached.

Conclusion

So, we’ve journeyed through Sammamish’s natural and cultural resources, seen the potential for sustainable growth, and faced the hurdles that stand in our way. But it’s clear that we’ve got the tools to overcome. With government initiatives paving the way and the community actively participating, we’re ready to make the most of what Sammamish has to offer. Our community gardens and cultural festivals are just the beginning. By knocking down legal barriers and financial obstacles, we’ll open the door to a whole host of opportunities. It’s all about working together, leveraging our local resources, and fostering a sustainable future for Sammamish. And I’m confident we’re on the right track. Let’s keep the momentum going, Sammamish!

by EastSide Explorer | Aug 18, 2024 | Sammammish

Nestled between the lush forests and sparkling lakes of Washington State, Sammamish has become a sought-after destination for homeowners. But buying a home here isn’t just about finding the perfect view—it’s about making smart decisions that set you up for long-term success.

As someone who’s navigated the Sammamish real estate market, I’m here to share some strategies that can make your homeownership journey smoother. Whether you’re a first-time buyer or a seasoned investor, there’s always something new to learn. So let’s delve into the world of smart homeownership in Sammamish, and discover how you can make the most of your investment.

Understanding Smart Homeownership

To traverse the path to homeownership in Sammamish with optimal outcomes, I suggest adopting smart homeownership practices. These are strategies developed from industry knowledge and practical experience, purposefully designed to help homeowners succeed.

Definition and Importance of Smart Homeownership

In my book, smart homeownership means mastering financial literacy and thoroughly understanding the real estate market before making a purchase. It’s about making informed decisions that align with your long-term goals. Now, you might wonder, what does smart homeownership bring to the table? Three words — stability, affordability, and value appreciation. Stability stems from owning a home instead of renting, freeing you from the whims of landlords and volatile rental markets. Affordability arises when you buy a house you can comfortably afford, not straining your finances. Lastly, value appreciation accrues over time as your property’s worth increases, building your wealth incrementally.

Relevance of Smart Homeownership in Sammamish

Sammamish, as I touted earlier, is a coveted locality to own a home. Its vibrant community, high-ranking schools, safe neighbourhoods — factors sought after by families looking to settle down. But it won’t be wrong for me to say that the allure of Sammamish also makes it an expensive real estate market. That’s where smart homeownership comes into play. By focusing on financial fitness first, selecting the right mortgage, and buying within your means, you can secure your dream home without debt overwhelming you. Similarly, by understanding the local market and projecting future trends, you can assure that your investment in a Sammamish home appreciates, thereby strengthening your financial position. It’s about playing the long game, my friends. Smart homeownership in Sammamish is so much more than just buying a home; it’s strategically investing in a future.

Strategies for Smart Homeownership in Sammamish

Let’s delve deeper into our smart homeownership strategies, focusing especially on thoroughly analyzing the Sammamish real estate market, evaluating financial readiness, identifying the best time to buy, and understanding the crucial role location plays in real estate values.

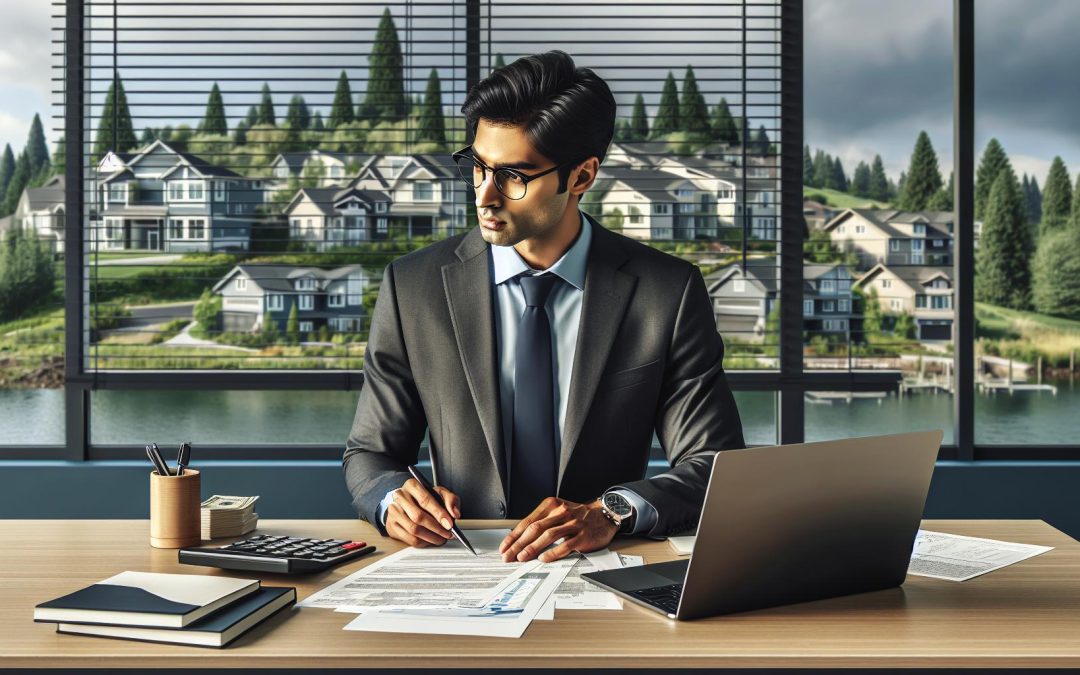

Analyzing the Sammamish Real Estate Market

Astute scrutiny of the Sammamish real estate market plays an instrumental role in shaping your homeownership strategy. It’s paramount to examine housing price trends, sales data, and market dynamics such as supply and demand. For instance, keep tabs on the number of homes for sale within Sammamish to understand where the market stands. A robust real estate market invites competition, heightening housing prices, whereas a softer market puts buyers in a stronger negotiation position.

Evaluating Your Financial Readiness

Before embarking on your homeownership journey in Sammamish, it’s pivotal to assess your financial readiness. Scrutinize your savings for a down payment, your credit history, and conscientiously manage your debt-to-income ratio. For instance, if your savings account boasts $20,000 and the average down payment in Sammamish is 10% of the home price, you’d be looking at homes priced up to $200,000. More than just being able to afford a mortgage, ultimate financial readiness implies comfortably managing monthly payments without hindering your lifestyle or other financial goals.

Considering the Best Time to Buy

Timing can be a game-changer in real estate. Market fluctuations can render some periods more advantageous to buy than others. Factors like seasonality often impact house prices, with spring typically seeing a surge in listings, and fall, a potential drop in prices. For instance, if you notice a healthy supply of homes in Sammamish in autumn, you could leverage this surplus to secure a better deal.

Understanding the Importance of Location

Location isn’t just important; it’s everything in real estate. A desirable location in Sammamish can not only enhance your quality of life but has the potential to significantly boost property values over time. Consider proximity to amenities such as schools, parks, and public transportation. Additionally, take into account the property’s potential for appreciation; for example, a home within walking distance of Sammamish’s top-rated schools will likely appreciate in value faster than a comparable home in a less popular school district.

Benefits of Smart Homeownership in Sammamish

Venturing into the real estate market in Sammamish isn’t just about owning a house – it’s about gaining financial stability, creating equity, and establishing an appealing and comfortable home. Here, I discuss these benefits in detail.

Financial Gains and Stability

Recognizing potential financial gains forms an essential part of smart homeownership. In Sammamish, homes often appreciate in value, contributing to your financial growth. For instance, the median home value in Sammamish stood at $400,000 in 2010. Fast forward to 2021, it soared to $1.1 million, demonstrating over 150% growth. Importantly, owning a home allows you to stabilize your housing costs. Your mortgage payment won’t increase even if the housing prices do because you locked your rate at the time of your purchase, offering significant savings over time.

Building Equity over Time

Building equity is another prime benefit of homeownership. Every mortgage payment you make, you’re contributing, even if slightly, to your own financial stability and not a landlord’s. As Sammamish homes continue to appreciate in value, the equity you accrue becomes more significant. For example, if a homeowner made an initial down payment of 20% on a $400,000 home in 2010, they’d have started with $80,000 in equity. Given the home’s value at $1.1 million in 2021, the equity would’ve reached $720,000 – a substantial growth over eleven years.

Creating a Beautiful and Comfortable Living Space

Creating a beautiful and comfortable living space isn’t just about aesthetics. It’s a means of imbuing your life with comfort and harmony. Being a homeowner allows you to design your home according to your tastes and lifestyle. For instance, you might want to renovate your kitchen or create a home office – changes that are often difficult or impossible in a rental property. Apart from comfort, improving your home’s aesthetic appeal can also raise its market value. A remodeled kitchen, for example, can provide a return on investment of up to 60-120%, making your home more valuable in Sammamish’s real estate market.

Overcoming Challenges in Smart Homeownership

In this section, I’ll dive into the unique challenges that prospective homeowners face in Sammamish and reveal strategies to overcome them.

Tackling High Housing Prices in Sammamish

Sammamish’s real estate market isn’t for the faint-hearted – it’s known for high housing prices. Buyers, however, can overcome this through preventive measures. They can apply for a mortgage, of course, reducing the upfront cash burden. Another measure is scrutinizing their finances and budget for a home cost within their reach. Additionally, studying up on the market trends in Sammamish might help the buyer to discover price drops at specific times of the year. Furthermore, seeking the assistance of an experienced real estate agent familiar with the Sammamish market can provide insights into affordable properties. A savvy agent can assist buyers by identifying potential negotiation opportunities, speeding up the home-buying process, and preventing costly mistakes.

Handling Maintenance Costs and Responsibilities

Maintenance costs and responsibilities pose a significant challenge for first-time homeowners. To manage maintenance costs effectively, homeowners in Sammamish can incorporate preventive measures to ward off unnecessary repairs. Keeping a properly funded emergency fund allows homeowners the freedom to tackle any unforeseen repair head-on. Also, routine inspections of utilities and appliances give homeowners ample time to tackle minor repairs before they escalate. I suggest investing in a home warranty, as it can save homeowners from the financial strain caused by unexpected appliance or system breakdowns.

Dealing with Property Taxes and Home Insurance

Property taxes and home insurance costs are other hurdles homeowners in Sammamish have to cross. Property taxes vary depending on the location of the property, so it’s important for homeowners to factor these into their budget figures. Be proactive in seeking professional tax advice to understand potential deductions. For home insurance, it’s essential to shop around. Get quotes from multiple insurance companies to ensure you’re not paying more than necessary. Also, maximizing home safety features could lower insurance costs, as many insurance companies offer discounts for homes with security systems, smoke detectors, and other safety measures.

Case Studies: Successful Smart Homeownership in Sammamish

Moving forward, let’s delve into some real-life examples of successful smart homeownership in Sammamish.

John and Mary’s Successful Homeownership Journey

John and Mary, longtime residents of Sammamish, offer a fantastic instance of smart homeownership. Initially, they rented a home near the city outskirts but had their eyes set on being homeowners. Akin to many first-time buyers, the high housing prices in Sammamish were Bernard’s primary challenge. Yet, they didn’t let it deter them.

Their story starts with an understanding of finances. They started saving while living within their means. For instance, instead of eating out frequently, they started home cooking. John also learned about different types of mortgages and studied property taxation.

To find a suitable house within their budget, they enlisted an experienced real estate agent’s help. The agent managed to find a house that required minor repairs, a fact that discouraged other potential buyers. John and Mary, however, saw this as an opportunity. Part of their homeownership strategy was taking preventive maintenance measures. So, they leaped at the chance.

Their strategy didn’t stop there. They shopped around for the best homeowners insurance price and maximized home safety features to lower costs. Finally, they also set up an emergency fund for unforeseen events. Today, their home’s market value has appreciated significantly, showcasing the effectiveness of their smart homeownership strategy.

How the Smiths Benefitted from Smart Homeownership

The story of the Smith family paints another picture of smart homeownership. Despite the Smiths earning a combined income, considerably lower than Sammamish’s median income, they own a comfortable home in the city’s heart. So, how did they do it?

Like John and Mary, the Smiths started by understanding the market. They attended various open houses, studied property prices, and familiarized themselves with property economics in the area. Knowing the importance of financial literacy, they also took a small course on it.

For their home, they took a 30-year fixed-rate mortgage, making their monthly payments more manageable. Once they moved in, they made smart decisions to keep their house in top shape, minimizing maintenance costs. They also kept their house energy-efficient, which further reduced month-to-month costs.

Unlike many other homeowners, the Smiths consciously chose not to live beyond their means. That meant prioritizing payments and opting for home warranties for protection against unexpected costs. By applying and sticking to these steps, the Smiths exemplify smart homeownership—a strategy they believe every prospective homeowner can embrace.

Conclusion

So there you have it. Smart homeownership in Sammamish isn’t just a pipe dream. It’s a reality for those who take the time to educate themselves about the market and make wise financial decisions. John and Mary’s journey, as well as the Smith family’s experience, show us that it’s entirely possible. They’ve shown us that with financial discipline, a deep understanding of the market, and a focus on home maintenance and safety, you can truly make the most of your investment. Remember, it’s not just about owning a home. It’s about making that home work for you. And with a little effort and a lot of smarts, you can do just that in Sammamish. After all, it’s not just a place to live. It’s a place to thrive.

by EastSide Explorer | Aug 18, 2024 | Sammammish

As a long-time resident of Sammamish, I’ve spent years navigating the ins and outs of our local tax system. Let’s face it, nobody enjoys paying taxes, but it’s an unavoidable part of life. That being said, there are ways to make the process a little less painful.

Understanding Sammamish’s Tax Laws

Understanding the basic taxation rules in Sammamish plays a vital role if you’re aiming to maximize your tax benefits. Here, I’ll help demystify the essentials of Sammamish’s tax regulations and bring to light the recent changes in its tax legislation.

What Are the Basics of Sammamish’s Tax Regulations?

Sammamish’s tax regulations hinge on three major taxa: property tax, sales tax, and business and occupation (B&O) tax. Property tax gets determined by your home’s assessed value. In 2020, the average property tax rate was 0.892% aiding in financing local government projects and services.

Sales tax, pegged at 9.6%, helps augment the city’s operational costs. Your purchases, except food and prescription medication, get subjected to this tax.

Lastly, the B&O tax, a gross receipts tax, applies to every person with business activities in Sammamish. It’s important to note the exemption of some businesses, e.g., non-profit organizations, from B&O tax.

Relevant Updates in Sammamish’s Tax Legislation

Sammamish’s tax legislation underwent some updates in recent years. In 2019, the King County Assessor’s office embarked on reassessing all properties in the city, which directly influenced the property tax rates.

Additionally, the State Legislature granted cities the right to implement higher sales tax rates for affordable housing. Sammamish took advantage of this to increase its sales tax from 9.5% to 9.6% in 2020.

Also, the city introduced a B&O tax in 2018 focusing on businesses whose annual total gross income exceeds $150,000. Notably, a credit of $1,000 per quarter got introduced for businesses that engage charitable activities in Sammamish.

Always keep abreast with these updates to mitigate surprises when filing your tax returns. Awareness aids in tax savings, which in turn maximizes your financial health.

Strategies for Maximizing Tax Benefits in Sammamish

No doubt, a little preparation can boost your tax savings. Keeping abreast with Sammamish’s tax laws and leveraging the available opportunities helps. Let’s ponder on useful tax deductions and credits applicable to Sammamish residents.

Deductions to Consider for Residents of Sammamish

For residents looking to maximize their tax benefits, several deductions could be candidates. First, real estate property taxes are directly deductible, as are mortgage interest expenses. If you own your home and carry a mortgage, don’t miss out on this. Second, Sales Tax deduction, an often overlooked area, is worth considering, especially if you’ve made large, taxable purchases throughout the year.

Vehicle licensing fees are another area where you might find deductions. Finally, charitable donations can be a powerful way to reduce your tax liability if you’re an active contributor to registered nonprofit organizations based in Sammamish.

Opportunities Within Sammamish’s Tax Credits

If you’re exploring tax credits in addition to deductions, there’s more room to revel in Sammamish. If you’re a business owner, the qualified business income (QBI) deduction offers attractive tax savings. It’s designed to benefit small to medium-sized businesses, reducing taxable income by up to 20% before calculating federal tax liabilities.

For families with children, don’t overlook the child and additional child tax credits. They can significantly reduce your federal tax bill, if you meet eligibility prerequisites. Lastly, if you’ve recently made energy-efficient improvements to your home, the Residential Energy Efficient Property Credit could prove lucrative. It caters to homeowners who’ve invested in ‘green’ upgrades, contributing to Sammamish’s sustainability efforts and reducing your tax bill simultaneously.

Remember, getting the most from your tax return often requires strategic planning and understanding of how local tax laws apply to your situation. Embrace that knowledge, and you’re sure to maximize your tax benefits in Sammamish.

The Role of Professional Tax Advisors in Sammamish

Transitioning from focusing on specific laws and benefits to the importance of professional guidance, I’ll highlight the role of tax advisors in ensuring you maximize tax benefits in Sammamish.

The Importance of Hiring a Local Tax Advisor

To navigate the complicated world of taxes, particularly in a locality like Sammamish with unique laws and regulations, you can’t beat local expertise. An experienced tax advisor, well-versed in Sammamish’s tax environment, is a vital asset. They’re often familiar with the specific tax-related intricacies of the area, such as the nuances of property tax reassessment, changes in sales tax, and the workings of local B&O tax. Consequently, their guidance can be invaluable in managing and even reducing your tax obligations. Now, let’s investigate how a tax advisor truly shines in helping to maximize your tax benefits.

How A Tax Advisor Helps to Maximize Tax Benefits

When it comes to capitalizing on tax benefits, tax advisors are key. They unravel the complexities, helping you grasp how to get the most from credits and deductions. For instance, they might suggest strategies for leveraging deductions related to real estate taxes, mortgage interest, and vehicle licensing fees. Moreover, they’ll make you aware of tax credits you may not know exist, like the Residential Energy Efficient Property Credit. By doing so, tax advisors ensure you’re taking full advantage of the varied tax incentives and benefits available in Sammamish, ultimately contributing to your financial well-being.

Real-Life Examples of Maximizing Tax Benefits in Sammamish

In our examination of maximizing tax benefits, let’s now dive into some real-life examples. Here, we’ll look at scenarios where individuals and businesses have successfully maximized their tax benefits, and we’ll also discuss lessons learned from tax planning missteps.

Stories of Successful Tax Reduction Cases

Meet Jade, a homeowner in Sammamish. She annually re-evaluates her property to catch up on any changes in property taxes. By doing so, Jade was able to successfully dispute a property tax assessment, leading to a significant reduction in her annual tax bill.

In another instance, we have TechSolutions, a local business. The company wisely took advantage of the recently introduced B&O tax deductions tailored for Sammamish businesses. The firm hired a local tax advisor familiar with the intricacies of the B&O tax. As a result, TechSolutions lowered its overall tax debt significantly.

Lessons Learned from Tax Planning Missteps

Though successfully maximizing tax benefits calls for celebration, it’s equally important to reflect on tax planning mishaps. A case in point is Amy, a small business owner who overlooked the benefits of the new B&O tax deductions, facing a severe blow to her year-end profits.

A more troubling case involves the Miller family, who didn’t prioritize real estate tax deductions. Not having reassessed their property’s value for years, they were paying much more in property taxes than their neighbors were.

The experiences of both Amy and the Miller family emphasize the necessity of staying abreast of tax law changes. Errors like these can lead to significant losses and just go to show the importance of strategic tax planning.

Remember, it’s not only about understanding the possibilities, but also about careful application and avoiding common tax planning missteps.

Tax Tools and Software for Sammamish Residents

Navigating tax laws in Sammamish becomes easier when equipped with the right tools and software. Let’s explore some of them in detail.

Overview of Useful Tax Tools for Sammamish Taxpayers

Several tax tools target specific aspects of the tax process. They include communication tools, tax calculators, deduction finders, and legal research tools. Communication tools like IRS2Go, a mobile application by the IRS, help taxpayers stay updated on their refund status, make payments, and receive tax tips. Sammamish residents can use tax calculators like TurboTax’s TaxCaster to estimate their tax refund or debt. Deduction finders like Deductr help small businesses track expenses and maximize deductions while applications like Fastcase and Casetext provide comprehensive and affordable tax law research resources. In essence, each tool has a specific task, making it easier for taxpayers to manage their tax obligations.

Using Software to Streamify Your Sammamish Taxes

Tax software adds efficiency and precision to tax management. Sammamish residents, businesses, and tax professionals can utilize tax software like TaxACT, H&R Block, and TurboTax to simplify tax preparation. For example, TaxACT has an intuitive process that guides users through every stage of tax filing, from income reporting to tax credit application. Meanwhile, H&R Block offers face-to-face assistance to software users, ensuring individuals and businesses navigate their tax situation with expert support. Lastly, TurboTax features a streamlined interface and a vast resource center to help users understand complex tax terms and laws. In short, carefully selected tax software can cut down the time and stress often associated with tax preparation.

Conclusion

We’ve journeyed through the complexities of Sammamish’s tax laws, highlighted recent legislation changes, and discussed strategies to maximize tax benefits. It’s clear that understanding these laws and staying up-to-date with changes is vital for your financial health. It’s equally important to use the right tools and get professional advice to navigate this complex terrain. Tax software and tools like IRS2Go, TaxCaster, Fastcase, and Casetext can be real game-changers. Remember, the goal is to reduce the time and stress associated with tax preparation. So, whether you’re an individual, a business owner, or a tax professional, I hope you’ve found this guide useful. Here’s to a stress-free tax season in Sammamish!

by EastSide Explorer | Aug 18, 2024 | Sammammish

Sammamish, a gem tucked away in the Pacific Northwest, is more than just a picturesque city. It’s a place where dreams can take root and flourish, especially for those seeking to build wealth. With its thriving economy and high standard of living, it’s no wonder why many are drawn to this city.

But how does one navigate the path to prosperity in Sammamish? How can you tap into the city’s wealth-building opportunities? That’s exactly what we’ll explore in this article. From real estate investments to flourishing local businesses, we’ll delve into the secrets of wealth creation in this beautiful city. So sit back, relax, and let’s embark on this journey to financial success together.

Understanding the Wealth Landscape in Sammamish

Sammamish presents varied opportunities for wealth accumulation. Let’s delve into its economy and wealth demographics to understand the city’s financial panorama better.

Key Economic Indicators

Sammamish demonstrates strong economic vitality, informed primarily by key components such as the city’s top-notch jobs market. With a low unemployment rate of 3.5%, compared to the national average of 6.7%, it’s evident job opportunities abound here. Additionally, the average income of Sammamish residents is $183,038, nearly triple the US average of $61,937, highlighting a blooming economy.[^1^]

The cost of living, another crucial economic indicator, is approximately 79.3% higher than the national average, with housing being a leading factor.[^2^] That puts forth a compelling reason for prospective investors to consider real estate in their wealth-building strategy.

[^1^]: Bureau of Labor Statistics

[^2^] Numbeo

Wealth Distribution

Wealth in Sammamish is fairly evenly spread, a fact confirmed by its Gini Coefficient of 0.41, just slightly higher than the US average of 0.48.^[3^]. Development of high-income professions in sectors like technology, a surge in property values over the last decade, and the presence of affluent neighborhoods, are primary reasons contributing to this wealth dispersion.

Additionally, almost 74% of the families in the city have an income of over $150,000 and around 54% of households own real estate properties.[^4^]. Thus endorsing, both high-income employment and property investment, are clear paths to wealth building in Sammamish.

Building Wealth: The Sammamish Real Estate Market

Diving deeper into Sammamish’s wealth-building avenues, property investment emerges as a critical player. Let’s explore how understanding this market can prove fruitful.

Understanding Property Investment

In Sammamish, property investment isn’t just about purchasing a house; it’s a strategy for securing financial growth. For example, home prices in Sammamish increased by an impressive 4.5% in the last year, indicating the strong potential for profits. Buying or investing in housing can also provide consistent rental income. It’s interesting to note, 46% of homes have at least two bedrooms, perfect for renting to small families. Moreover, the low vacancy rate of just 3.8% makes rental properties in Sammamish a safe bet.

Rental yield – a key figure in evaluating rental prospects – is obtained by dividing the yearly incoming rent by the property’s market value. Owners can enjoy strong net incomes with Sammamish’s annual rental yields on par with the national average.

Real Estate Trends in Sammamish

Keeping track of local real estate trends, crucial for success in the property market, isn’t as daunting as it might seem. Over the past decade, median home value in Sammamish has skyrocketed from $413,100 in 2009, to a stunning $830,800 in 2019.

Data suggests this upward momentum isn’t slowing. In fact, housing market predictions for Sammamish suggest an additional 7.5% growth in home value over the next year.

Despite the high cost of property, Sammamish’s residents appear to consider it a worthwhile investment, with over half of them owning their homes.

By buying property in Sammamish, investors not only secure a tangible asset, they also enter a steady market likely to register consistent growth. With the right investment choices, one can grow wealth significantly in this Pacific Northwest gem of a city.

The Role of Business Investments

As we dive deeper into wealth-building in Sammamish, let’s explore another key avenue: business investments. Here, we’ll spotlight profitable businesses and successful local entrepreneurs.

Profitable Businesses in Sammamish

Sammamish benefits from a diverse range of productive commercial endeavors. Among the numerous sectors, Tech-based enterprises stand out as particularly profitable, capitalizing on the city’s close proximity to Seattle’s booming tech industry. Leading companies like Microsoft, Amazon, and Google have offices nearby. This, in turn, creates a fertile ground for tech-based startups and consultant businesses in Sammamish.

Alongside this, niche industries like event catering, dog-walking, and landscape services have seen growth, demonstrating Sammamish’s capacity for thriving small businesses. Catering businesses, for instance, are fueled by the city’s bustling event scene, while dog-walking services are popular among the city’s pet-friendly residents.

Success Stories of Local Entrepreneurs

One sees the power of business investments through the success stories of local entrepreneurs. Take the example of Andrew Ballard, founder of Marketing Solutions, a company that develops research-based growth strategies. Starting as a small business in Sammamish, Marketing Solutions has grown into a sought-after consultant firm because of Ballard’s innovative strategies and the growing demand for marketing consultation.

In another striking example, we have Emily and Elizabeth Kim, sisters who started Moonie Icy Tunes, an ice cream truck company. What began as a nostalgic nod to their childhood ice cream truck experiences has transformed into a successful venture that now includes several trucks and caters to numerous events in and around Sammamish.

Through these windows of business investment, there lies potential for wealth building in Sammamish, providing both residents and investors diverse avenues to grow financially.

Sammamish Stock Market and Investments

Sammamish’s potent economy presents itself as a sound stage for stock market investments. The city’s financial health and residents’ impressive purchasing power open avenues for meaningful and beneficial returns.

Evaluating the Local Stock Market

A crucial element in the wealth building journey is understanding the nuances of Sammamish’s local stock market. It’s an area that exhibits considerable growth, given the city’s proximity to the thriving hub of Seattle’s tech industry. Major stocks have ties to technological giants such as Microsoft, Amazon, and Google, well-established companies with strong performance histories. The local market also thrives on shares associated with smaller businesses excelling in diverse sectors. Stocks representative of local success stories like Andrew Ballard’s Marketing Solutions and the Kim sisters’ Moonie Icy Tunes form part of the city’s diverse investment basket. Keep in mind, an informed investor considers factors like a company’s fiscal health, its operational sector’s future prospects, and economic forecasts. Resources like portfolio management tools and financial consultancy services provide necessary assistance, helping deduce and manage risk-reward ratios to yield effective returns.

Smart Investing Strategies

Smart investing strategies pave the way for successful wealth accumulation in Sammamish. The city’s robust financial landscape provides a foundation for a range of strategies, be it value investing, growth investing, or income investing.

Value investors look for stocks perceived as undervalued relative to their intrinsic worth. Companies with stable financials but temporarily undervalued stocks—mostly due to market fluctuations—are prime targets. Growth investing, by contrast, identifies businesses showing above-average growth, regardless of the current stock price—tech stocks exemplify such opportunities.

Income investing focuses on generating steady income, primarily through dividend-paying stocks. It’s an effective approach, particularly for retirees seeking a regular income stream. Keep in mind, balancing these strategies according to your financial goals, risk tolerance, and investment timeline optimizes investment returns, facilitating robust wealth building in Sammamish.

Financial Planning for Wealth Building in Sammamish

Reaping the benefits of Sammamish’s robust economy entails astute planning of financial activities. Let’s dive into the significance of expert advice and intellective tax planning for steady wealth accumulation.

Importance of a Financial Advisor

A financial advisor provides pivotal support in charting your wealth building journey in Sammamish. They offer personalized strategies, taking into account specific financial goals, present financial condition, and risk profile. For instance, their advice might be instrumental when deciding between investment options, like buying property in Sammamish’s booming real estate market, putting capital into thriving local businesses, or investing in prominent stocks. Furthermore, they guide on when to enter and exit investments, reducing the risk caused by market volatility.

In addition, advisors disentangle complicated financial situations and provide simplified explanations. An example is estate planning; understanding associated laws can be challenging without expert guidance. They use their comprehensive knowledge to develop practices that foster financial growth while protecting assets from potential pitfalls.

Tax Planning and Wealth Management

In the wealth-building equation, tax planning plays a critical factor since taxes significantly impact net investment returns. Implementing smart tax strategies enhances financial growth by minimizing tax liabilities.

For instance, consider real estate investments in Sammamish. Shrewdly leveraging tax benefits can augment returns. Investors might benefit from mortgage interest deductions, property tax deductions, and can also defer tax payments through techniques like a 1031 exchange.

Involving in local businesses, one can take advantage of various tax incentives provided by the city to support small enterprises. This might include deductions on business expenses such as office supplies, or vehicle expenses if it relates to your business.

On the shares front, capital gains tax plays a vital role. It’s essential to know when to hold or sell stocks to optimize tax liabilities. For example, holding shares for more than a year entitles an investor to long-term capital gains tax, typically lower than short-term.

Conclusively, a well-designed tax plan helps in asset preservation and accelerates wealth accumulation, putting you on the fast track to building wealth in Sammamish.

Community and Networking Opportunities

In Sammamish, engaging with professional communities and participating in wealth-building networking events play crucial roles in growing personal financial wealth.

Engaging with Professional Communities

Becoming involved with professional communities in Sammamish is one significant way of strengthening financial prospects. I’ve noticed that local professional groups and organizations are vibrant platforms that inspire knowledge sharing and mutual growth. For instance, the Sammamish Chamber of Commerce provides numerous opportunities to connect with established local businesses, encouraging socio-economic engagement across the city.

Tech professionals can especially benefit from this region’s proximity to Seattle’s tech giants, such as Google and Microsoft. They offer various meetup groups, like the Google Developers Group or Microsoft’s .NET Developers Association, where one can learn about the latest trends and possibilities directly from industry veterans. It’s imperative to understand, though, that these professional communities aren’t only about what you obtain; they’re as much about what you contribute.

Wealth-building Networking Events in Sammamish

Attending networking events specific to wealth-building in Sammamish is another useful strategy. Many of these events aim at facilitating dialogues about financial growth, including discussions on property investment, stock market strategies, and setting up small businesses. For example, Sammamish’s “Investor’s Business Daily Meetup Group” provides a robust platform for aspiring investors to talk about their financial plans and glean insights from seasoned investors. It’s also worth noting that such events often host various successful local entrepreneurs and financial advisors, providing an excellent opportunity to learn from their experiences first-hand.

But remember, networking doesn’t stop when the event ends. Savvy networkers know that it’s vital to follow up, nurturing connections, resolving queries and deliberations, and sometimes, even establishing mutual mentorship. After all, building wealth in Sammamish is as much about gaining new knowledge and insights as it is about building substantial relationships that contribute to financial growth and success.

Conclusion

I’ve got to say, building wealth in Sammamish seems like an exciting adventure. The city’s strong economy and high average income make it a hotbed for financial growth. Whether it’s through real estate investments, launching a thriving business, or smart stock market strategies, there are plenty of avenues to explore. And let’s not forget the power of networking. Engaging with the community, attending events, and making valuable connections can open doors to opportunities you might not have considered. So, if you’re thinking of making a financial move in Sammamish, you’re onto something big. As we’ve seen, it’s not just about having the resources, but also about making the right choices and leveraging the opportunities that this vibrant city offers. It’s clear that Sammamish is a city where dreams of wealth accumulation can become a reality.