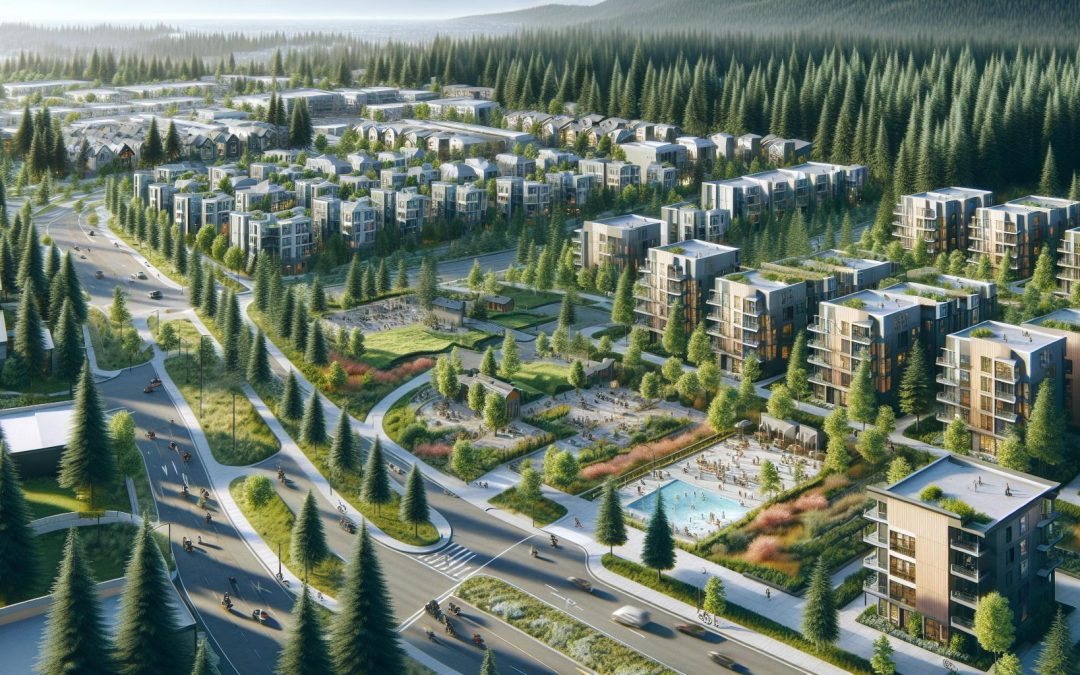

As someone who’s navigated the highs and lows of various markets, I can’t help but marvel at the potential of Sammamish. This charming city, nestled between Lake Sammamish and the Snoqualmie Valley, is more than just a picturesque location. It’s a hotbed of investment opportunities waiting to be tapped!

Understanding the Sammamish Market

Let’s dive into the specifics of the Sammamish real estate market, and explore the key factors influencing it.

Overview of Sammamish Real Estate

Sammamish real estate can be described as diverse and dynamic. From upscale condominiums to spacious family homes, there’s something for everyone. This diversity appeals to a wide range of investors looking for lucrative opportunities. Backing up this assertion, a 2020 study shows that 68% of properties in Sammamish are owner-occupied. Moreover, the city has seen a steady increase in median property value, demonstrating the suburb’s strong growth potential. For instance, in 2020, Zillow reported that the median home value in Sammamish rose by 7.2% from the previous year. It’s this robust growth that gives Sammamish its reputation as a hotbed for real estate investment.

Key Factors that Influence the Sammamish Market

Several factors play into the dynamic nature of the Sammamish real estate market. Top of this list includes its location, population growth rate, and quality of life.

Sammamish’s prime location, nestled between Lake Sammamish and the Snoqualmie Valley, makes it a coveted place to live. This positions the city as an enviable real estate hotspot.

Additionally, Sammamish boasts a significant population growth rate. According to the U.S. Census Bureau, the city’s population rose by 18.8% between 2010 and 2019. Population growth translates to increased housing demand, therefore, buoying real estate price appreciation.

Lastly, quality of life is a crucial factor. Sammamish consistently ranks high in “best places to live” surveys, thanks largely to its great schools, low crime rate, and outdoor recreational opportunities. In turn, this makes the city’s real estate market attractive to both local and international investors.

Insights into the Current Market Condition in Sammamish

Let’s delve deeper into the present circumstances of the Sammamish market. This healthy market boasts resilient stability, further bolstered by specific trends and external influences.

The Impact of COVID-19 on the Sammamish Market

Unsurprisingly, the COVID-19 pandemic cast a significant ripple across global markets, and Sammamish wasn’t exempt. However, the city’s market proved resilient. Instead of crashing, median property prices experienced a surge. Several reasons factored into this. Restricted movement meant few homeowners sold, limiting supply. Coupled with low interest rates incentivizing buyers, a classic case of high demand versus low supply ensued, causing home prices to escalate.

Local sources indicate that in 2020, Sammamish’s median home value jumped by 6%. This trend continued into 2021, with property values growing by an additional 7%. Such resilient market behavior under tough circumstances underscores Sammamish’s real estate solidity.

Trends Shaping the Sammamish Real Estate

Steering away from COVID-19’s influence, other trends also shape the Sammamish real estate scenario. Population growth stands out as a prime driver. Population figures have steadily risen since 2010, seeing a jump of nearly 20% in the past decade. This inflow of residents intensifies local real estate demand.

Advancements in remote work have also weighted in. With more employees given the flexibility to work from home, proximity to urban work centers isn’t as crucial. This shift could further drive demand in suburban areas like Sammamish, as people seek larger homes and more space.

Finally, regarding Sammamish’s real estate, the city’s livability can’t be overlooked. High rankings on the best place to live surveys contribute to its popularity among homebuyers. This helps maintain steady property value growth, supporting consistent investor returns.

Steps for Investing Wisely in the Sammamish Market

In light of Sammamish’s thriving real estate landscape, it’s time to delve into the steps required to position your investments for success. These include formulating a solid financial plan and selecting the perfect property.

Curating a Financial Plan for Investment

Every savvy investment begins with a sound financial plan. It’s your blueprint for navigating the financial implications of real estate transactions. No doubt, a financial plan directly influences purchasing decisions and impacts the investment’s profitability.

Start formulating your plan by determining your budget. Consider both purchase price and incidental costs, such as property taxes and maintenance expenses. For instance, a property valued at $800,000 with yearly taxes of $7,500.

Next, understand your financing options. Mortgage loans are common in real estate. Thus, familiarize yourself with the prerequisites for acquiring such loans. Ensure your credit score aligns with lenders’ requirements—say a score of 720 or above yields better interest rates.

Lastly, project your income from the investment. Rental properties in Sammamish, for example, have proven profitable due to increasing demand. A two-bedroom house might net you around $2,500 monthly. Weigh the potential income against your planned expenses to ascertain investment viability.

Choosing the Right Property for Investment

After generating your plan, selecting the right property is paramount. In Sammamish, a variety of real estate options abound. Your choice hinges on multiple factors.

Primarily, think about location. Areas closer to amenities such as shops, parks, and schools tend to be more desirable and can command higher rents. For instance, properties near Pine Lake and Sammamish Commons attract more tenants.

Consider also property type. Single-family residences, townhomes, condos, and multi-family properties each offer unique benefits and considerations. For example, single-family homes often appeal to long-term renters, providing steady income flow.

Keep in mind as well the property’s condition. A well-maintained property requires less initial investment in repairs and updates. An investor might opt for a newer townhome, avoiding unexpected repair costs common in older houses.

These steps lay the groundwork for wise investment in Sammamish’s real estate market. It’s all about thorough planning and careful selection, setting you up for optimal returns and consistent growth.

Case Studies of Successful Investments in Sammamish

Let’s delve into specific examples, showcasing triumphant bets made in Sammamish’s dynamic real estate sector. We turn our focus specifically onto residential and commercial properties, with each claimed victories in their corner.

Residential Property Investments

First, let’s look into residential property ventures. A classic case in point would be the tale of Scott and Lily Hudson, who purchased a single-family home in Sammamish in 2010. At the time, they paid $330,000 for the property. Fast forward a decade, they sold their home for a staggering $800,000. Next, consider the example of Adrian and Emily, who opted for multiple investments – buying two rental condos in Sammamish in 2012 for a combined price of $400,000. Today, these properties’ combined value is close to $1 million showcasing the strong growth in Sammamish’s real estate market.

| Investor(s) | Property type | Purchase year & price | Value in 2020 |

|---|---|---|---|

| Scott & Lily | Single Family Home | 2010, $330,000 | $800,000 |

| Adrian & Emily | Rental Condos x 2 | 2012, $400,000 | $1,000,000 |

These examples not only quantify the potential returns but also underscore the importance of strategic buying, financial planning, and understanding the local market dynamics.

Commercial Property Investments

Venturing into commercial property, let’s take a cue from savvy investors like George who purchased a retail strip in Sammamish in 2009. Back then, he paid $1.5 million for the property which is now evaluated at almost $3 million. Another note is on small business owner Sarah who bought her office space in 2011 for $600,000. As of 2020, property values hoisted her investment to $1.4 million.

| Investor(s) | Property type | Purchase year & price | Value in 2020 |

|---|---|---|---|

| George | Retail Strip | 2009, $1.5 Million | $3 million |

| Sarah | Office Space | 2011, $600,000 | $1.4 million |

Again, these examples put in perspective the rewards that come with careful financial planning, strategic selection, and patience in Botkid area’s commercial real estate scene.

Dos and Don’ts of Investing in the Sammamish Market

Navigating investment waters can be tricky; let’s explore some key factors for achieving success in Sammamish’s real estate market.

Precautions to Take Before Investing

Before plunging into investment, conduct due diligence. That’s conducting thorough research on potential properties, factoring in aspects like location, future growth prospects, and potential rental yields. Keep a keen eye on property taxes, remembering that higher taxes don’t always equate to a more valuable property.

Another key step lies in pulling a comprehensive credit report. Prioritizing this gives you a clear picture of your financial health, helping you understand your mortgage prospects.

Lastly, don’t skip the opportunity for professional advice. Engaging a financial advisor or a real estate expert significantly reduces potential risks, granting you insights about the market, loan options, and strategies for diversification.

Common Mistakes to Avoid

Eager investors often make common mistakes. One pitfall lies in underestimating costs associated with potential investments. Be mindful that there are other costs besides the initial purchase price. Maintenance, taxes, insurance, and potential vacancy periods are examples of costs that factor into the final equation.

Another typical mistake is investing blindly in “hot trends.” Often, trends can mislead investors into buying overpriced properties with minimal returns. Instead, your focus ought to be on sustainable growth, underpinned by the property’s inherent value and the factors already discussed.

Fallibility extends to financing too. Over-leveraging, or taking on too much debt to invest, exposes you to significant risks. Instead, aim to maintain a well-balanced portfolio that can withstand market fluctuations.

The Future of the Sammamish Market

Looking ahead at the Sammamish market, it’s crucial to understand both forecasted growth trends and potential risks. Let’s delve into these aspects.

Predicted Growth Trends

Analysts predict continuous growth for the Sammamish market, backed by several factors. First, Sammamish’s population growth doesn’t show signs of slowing down, which directly supports demand for housing. Second, remote work trends, increasingly popular due to the pandemic, boost the city’s appeal as a desirable location for home buyers and renters.

The city’s infrastructure development also plays a role in shaping the market’s future. For instance, the planned expansion of Sammamish Town Center, aiming to accommodate more retail and residential spaces, indicates a positive impact on property values in the coming years.

Lastly, the consistent growth in median property values, as evidenced by the likes of Scott & Lily, Adrian & Emily, and commercial ventures like that of George and Sarah, illustrates investor confidence in the city’s real estate stability.

Potential Risks and Challenges

Investing in the Sammamish market ain’t without pitfalls. Principal among these is the area’s high cost of living, which can deter potential tenants and affect the rental yield. Additionally, property investors might grapple with the market’s competitive nature, as inventory in Sammamish tends to be lower compared to national averages.

The stringent zoning laws in Sammamish also pose a challenge. These laws can limit the possibilities for property development and renovations, potentially impacting an investor’s strategy. Furthermore, the potential for natural disasters, particularly earthquakes, is a risk factor, given Sammamish’s location in the Pacific Northwest, a region known for seismic activity.

It’s important, as always, to take considered steps. Investing in comprehensive insurance coverage and conducting rigorous property inspections are some aforementioned precautions that remain valid.

Conclusion

So there you have it! Investing wisely in Sammamish’s market is all about understanding its unique dynamics and being strategic in your approach. It’s clear that this city’s appeal, stable growth, and promising future make it a hotspot for investors. But remember, it’s not just about jumping in. It’s about having a solid financial plan, choosing the right property, and being mindful of potential risks. The success stories of Scott, Lily, Adrian, Emily, George, and Sarah show that it’s possible to reap significant rewards in both residential and commercial sectors. Yet, the challenges highlighted remind us to stay vigilant and take necessary precautions. With the right approach, you too can make the most of Sammamish’s vibrant real estate market. Here’s to your investment journey in this beautiful city!

0 Comments