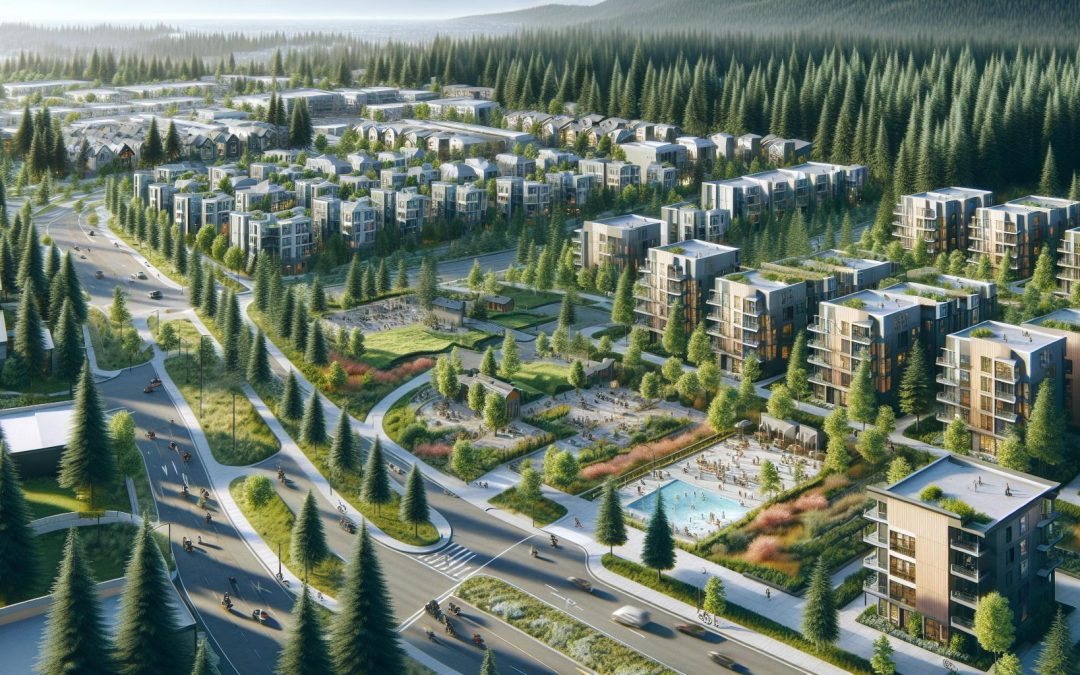

Nestled between the lush forests and sparkling lakes of Washington State, Sammamish has become a sought-after destination for homeowners. But buying a home here isn’t just about finding the perfect view—it’s about making smart decisions that set you up for long-term success.

As someone who’s navigated the Sammamish real estate market, I’m here to share some strategies that can make your homeownership journey smoother. Whether you’re a first-time buyer or a seasoned investor, there’s always something new to learn. So let’s delve into the world of smart homeownership in Sammamish, and discover how you can make the most of your investment.

Understanding Smart Homeownership

To traverse the path to homeownership in Sammamish with optimal outcomes, I suggest adopting smart homeownership practices. These are strategies developed from industry knowledge and practical experience, purposefully designed to help homeowners succeed.

Definition and Importance of Smart Homeownership

In my book, smart homeownership means mastering financial literacy and thoroughly understanding the real estate market before making a purchase. It’s about making informed decisions that align with your long-term goals. Now, you might wonder, what does smart homeownership bring to the table? Three words — stability, affordability, and value appreciation. Stability stems from owning a home instead of renting, freeing you from the whims of landlords and volatile rental markets. Affordability arises when you buy a house you can comfortably afford, not straining your finances. Lastly, value appreciation accrues over time as your property’s worth increases, building your wealth incrementally.

Relevance of Smart Homeownership in Sammamish

Sammamish, as I touted earlier, is a coveted locality to own a home. Its vibrant community, high-ranking schools, safe neighbourhoods — factors sought after by families looking to settle down. But it won’t be wrong for me to say that the allure of Sammamish also makes it an expensive real estate market. That’s where smart homeownership comes into play. By focusing on financial fitness first, selecting the right mortgage, and buying within your means, you can secure your dream home without debt overwhelming you. Similarly, by understanding the local market and projecting future trends, you can assure that your investment in a Sammamish home appreciates, thereby strengthening your financial position. It’s about playing the long game, my friends. Smart homeownership in Sammamish is so much more than just buying a home; it’s strategically investing in a future.

Strategies for Smart Homeownership in Sammamish

Let’s delve deeper into our smart homeownership strategies, focusing especially on thoroughly analyzing the Sammamish real estate market, evaluating financial readiness, identifying the best time to buy, and understanding the crucial role location plays in real estate values.

Analyzing the Sammamish Real Estate Market

Astute scrutiny of the Sammamish real estate market plays an instrumental role in shaping your homeownership strategy. It’s paramount to examine housing price trends, sales data, and market dynamics such as supply and demand. For instance, keep tabs on the number of homes for sale within Sammamish to understand where the market stands. A robust real estate market invites competition, heightening housing prices, whereas a softer market puts buyers in a stronger negotiation position.

Evaluating Your Financial Readiness

Before embarking on your homeownership journey in Sammamish, it’s pivotal to assess your financial readiness. Scrutinize your savings for a down payment, your credit history, and conscientiously manage your debt-to-income ratio. For instance, if your savings account boasts $20,000 and the average down payment in Sammamish is 10% of the home price, you’d be looking at homes priced up to $200,000. More than just being able to afford a mortgage, ultimate financial readiness implies comfortably managing monthly payments without hindering your lifestyle or other financial goals.

Considering the Best Time to Buy

Timing can be a game-changer in real estate. Market fluctuations can render some periods more advantageous to buy than others. Factors like seasonality often impact house prices, with spring typically seeing a surge in listings, and fall, a potential drop in prices. For instance, if you notice a healthy supply of homes in Sammamish in autumn, you could leverage this surplus to secure a better deal.

Understanding the Importance of Location

Location isn’t just important; it’s everything in real estate. A desirable location in Sammamish can not only enhance your quality of life but has the potential to significantly boost property values over time. Consider proximity to amenities such as schools, parks, and public transportation. Additionally, take into account the property’s potential for appreciation; for example, a home within walking distance of Sammamish’s top-rated schools will likely appreciate in value faster than a comparable home in a less popular school district.

Benefits of Smart Homeownership in Sammamish

Venturing into the real estate market in Sammamish isn’t just about owning a house – it’s about gaining financial stability, creating equity, and establishing an appealing and comfortable home. Here, I discuss these benefits in detail.

Financial Gains and Stability

Recognizing potential financial gains forms an essential part of smart homeownership. In Sammamish, homes often appreciate in value, contributing to your financial growth. For instance, the median home value in Sammamish stood at $400,000 in 2010. Fast forward to 2021, it soared to $1.1 million, demonstrating over 150% growth. Importantly, owning a home allows you to stabilize your housing costs. Your mortgage payment won’t increase even if the housing prices do because you locked your rate at the time of your purchase, offering significant savings over time.

Building Equity over Time

Building equity is another prime benefit of homeownership. Every mortgage payment you make, you’re contributing, even if slightly, to your own financial stability and not a landlord’s. As Sammamish homes continue to appreciate in value, the equity you accrue becomes more significant. For example, if a homeowner made an initial down payment of 20% on a $400,000 home in 2010, they’d have started with $80,000 in equity. Given the home’s value at $1.1 million in 2021, the equity would’ve reached $720,000 – a substantial growth over eleven years.

Creating a Beautiful and Comfortable Living Space

Creating a beautiful and comfortable living space isn’t just about aesthetics. It’s a means of imbuing your life with comfort and harmony. Being a homeowner allows you to design your home according to your tastes and lifestyle. For instance, you might want to renovate your kitchen or create a home office – changes that are often difficult or impossible in a rental property. Apart from comfort, improving your home’s aesthetic appeal can also raise its market value. A remodeled kitchen, for example, can provide a return on investment of up to 60-120%, making your home more valuable in Sammamish’s real estate market.

Overcoming Challenges in Smart Homeownership

In this section, I’ll dive into the unique challenges that prospective homeowners face in Sammamish and reveal strategies to overcome them.

Tackling High Housing Prices in Sammamish

Sammamish’s real estate market isn’t for the faint-hearted – it’s known for high housing prices. Buyers, however, can overcome this through preventive measures. They can apply for a mortgage, of course, reducing the upfront cash burden. Another measure is scrutinizing their finances and budget for a home cost within their reach. Additionally, studying up on the market trends in Sammamish might help the buyer to discover price drops at specific times of the year. Furthermore, seeking the assistance of an experienced real estate agent familiar with the Sammamish market can provide insights into affordable properties. A savvy agent can assist buyers by identifying potential negotiation opportunities, speeding up the home-buying process, and preventing costly mistakes.

Handling Maintenance Costs and Responsibilities

Maintenance costs and responsibilities pose a significant challenge for first-time homeowners. To manage maintenance costs effectively, homeowners in Sammamish can incorporate preventive measures to ward off unnecessary repairs. Keeping a properly funded emergency fund allows homeowners the freedom to tackle any unforeseen repair head-on. Also, routine inspections of utilities and appliances give homeowners ample time to tackle minor repairs before they escalate. I suggest investing in a home warranty, as it can save homeowners from the financial strain caused by unexpected appliance or system breakdowns.

Dealing with Property Taxes and Home Insurance

Property taxes and home insurance costs are other hurdles homeowners in Sammamish have to cross. Property taxes vary depending on the location of the property, so it’s important for homeowners to factor these into their budget figures. Be proactive in seeking professional tax advice to understand potential deductions. For home insurance, it’s essential to shop around. Get quotes from multiple insurance companies to ensure you’re not paying more than necessary. Also, maximizing home safety features could lower insurance costs, as many insurance companies offer discounts for homes with security systems, smoke detectors, and other safety measures.

Case Studies: Successful Smart Homeownership in Sammamish

Moving forward, let’s delve into some real-life examples of successful smart homeownership in Sammamish.

John and Mary’s Successful Homeownership Journey

John and Mary, longtime residents of Sammamish, offer a fantastic instance of smart homeownership. Initially, they rented a home near the city outskirts but had their eyes set on being homeowners. Akin to many first-time buyers, the high housing prices in Sammamish were Bernard’s primary challenge. Yet, they didn’t let it deter them.

Their story starts with an understanding of finances. They started saving while living within their means. For instance, instead of eating out frequently, they started home cooking. John also learned about different types of mortgages and studied property taxation.

To find a suitable house within their budget, they enlisted an experienced real estate agent’s help. The agent managed to find a house that required minor repairs, a fact that discouraged other potential buyers. John and Mary, however, saw this as an opportunity. Part of their homeownership strategy was taking preventive maintenance measures. So, they leaped at the chance.

Their strategy didn’t stop there. They shopped around for the best homeowners insurance price and maximized home safety features to lower costs. Finally, they also set up an emergency fund for unforeseen events. Today, their home’s market value has appreciated significantly, showcasing the effectiveness of their smart homeownership strategy.

How the Smiths Benefitted from Smart Homeownership

The story of the Smith family paints another picture of smart homeownership. Despite the Smiths earning a combined income, considerably lower than Sammamish’s median income, they own a comfortable home in the city’s heart. So, how did they do it?

Like John and Mary, the Smiths started by understanding the market. They attended various open houses, studied property prices, and familiarized themselves with property economics in the area. Knowing the importance of financial literacy, they also took a small course on it.

For their home, they took a 30-year fixed-rate mortgage, making their monthly payments more manageable. Once they moved in, they made smart decisions to keep their house in top shape, minimizing maintenance costs. They also kept their house energy-efficient, which further reduced month-to-month costs.

Unlike many other homeowners, the Smiths consciously chose not to live beyond their means. That meant prioritizing payments and opting for home warranties for protection against unexpected costs. By applying and sticking to these steps, the Smiths exemplify smart homeownership—a strategy they believe every prospective homeowner can embrace.

Conclusion

So there you have it. Smart homeownership in Sammamish isn’t just a pipe dream. It’s a reality for those who take the time to educate themselves about the market and make wise financial decisions. John and Mary’s journey, as well as the Smith family’s experience, show us that it’s entirely possible. They’ve shown us that with financial discipline, a deep understanding of the market, and a focus on home maintenance and safety, you can truly make the most of your investment. Remember, it’s not just about owning a home. It’s about making that home work for you. And with a little effort and a lot of smarts, you can do just that in Sammamish. After all, it’s not just a place to live. It’s a place to thrive.

0 Comments